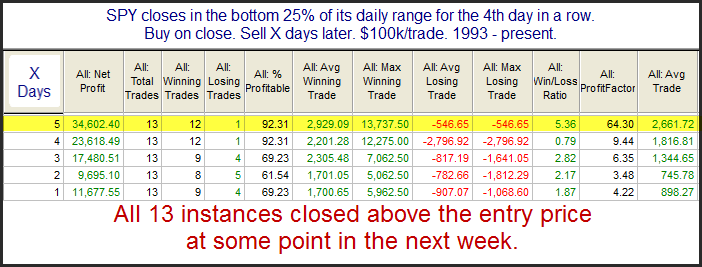

Despite attempts to put in rallies over the last few days, SPY has been persistently weak in the afternoon. It has not managed to hold gains and has closed in the bottom 25% of its daily range for the last 4 days in a row. That may not sound all that extreme, but it is pretty rare. Below is a look at how the market has performed following past occurrences. It looks back to the inception of SPY in 1993.

Instances are a little low, but the numbers are very lopsided in favor of the bulls. It will be interesting to see if the market can overcome its current funk and large gap down this morning to keep the string of short-term rallies alive.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.