In last Wednesday’s blog I showed a study that the quick move from overbought to oversold in the VIX appeared suggestive of further upside.

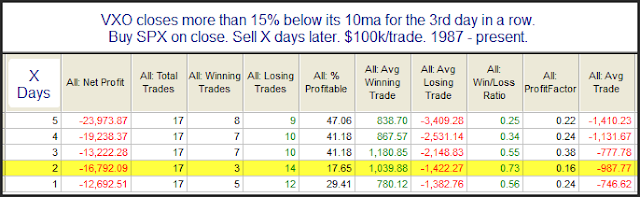

But now we find ourselves in a situation where the VXO got extremely stretched has remained so for three days in a row. I decided to take a look at other times where this kind of extended stretch had occurred.

The numbers here appear to strongly suggest a short-term downside edge. More detailed analysis was done on the instances in last night’s subscriber letter. That analysis also supported the case for a short-term pullback.

To take a trial of Quantifiable Edges and see last night’s detailed version of this study, click here to take a free 1-week trial.