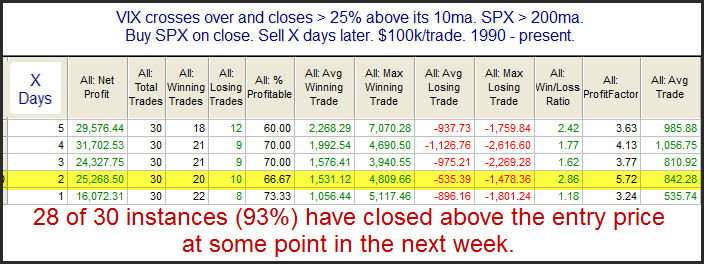

Friday’s big drop was accompanied by a big spike in options prices as measured by the VIX. The VIX rose so sharply that it closed Friday 32% above its 10-day moving average. The study below examines stretches of 25% or more, and how the SPX has performed in the following days.

Very impressive consistency. Sizable bounces seem to have been the norm under these circumstances. There seems to be a decent chance of a bounce in the next few days – and this is not the only study I examined this weekend that is suggesting that.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.