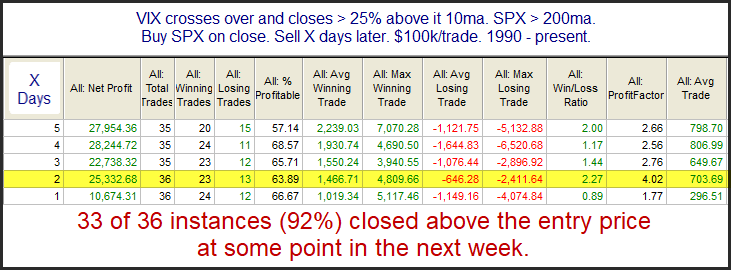

While the SPX declined sharply on Monday, the VIX index rose sharply. In fact, the VIX closed nearly 30% above its 10-day moving average. A stretched VIX is often a sign of an overly fearful market. It will often be followed a strong reversal. The study below is from last night’s Subscriber Letter. It exemplifies this.

Very impressive consistency. Quick bounces seem to have been the norm under these circumstances. Traders may want to keep this in mind over the next few days.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.