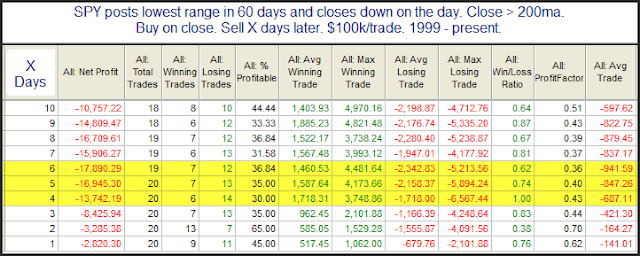

The market was down a little and no one seemed to care. Volume was extremely light, and the range was the lowest in months. This kind of indifference can sometimes mean that bulls are done (temporarily). They pushed prices higher leading up to Monday then held a buying strike. Often this kind of action will be followed by sellers entering the market to fill the vacuum that is being created with the buyers leaving. A number of studies triggered yesterday that exemplify this concept. Below is one.

Such extremely low range on a day the SPY dips a little has commonly been followed by a further drop. I will note that the short side does not have the QE Buying Power Index in its favor…but it will soon.