In the past I have shown that the Thursday before Easter (also known as Holy Thursday) has exhibited a bullish inclination over the years. Last year I broke out that performance by overnight vs. intraday returns. I have updated that research today. Intraday returns will be shown here. Overnight returns can be found on Overnight Edges.

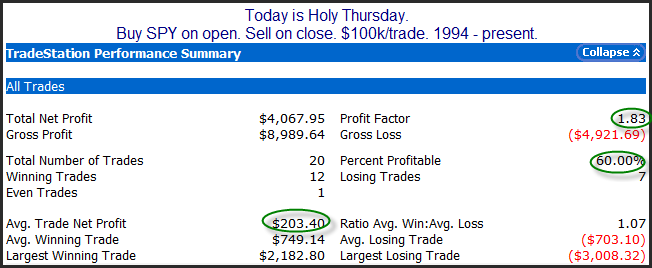

The study below shows historical performance from open to close on Holy Thursday.

Numbers here appear solidly bullish. Below is the list of instances.

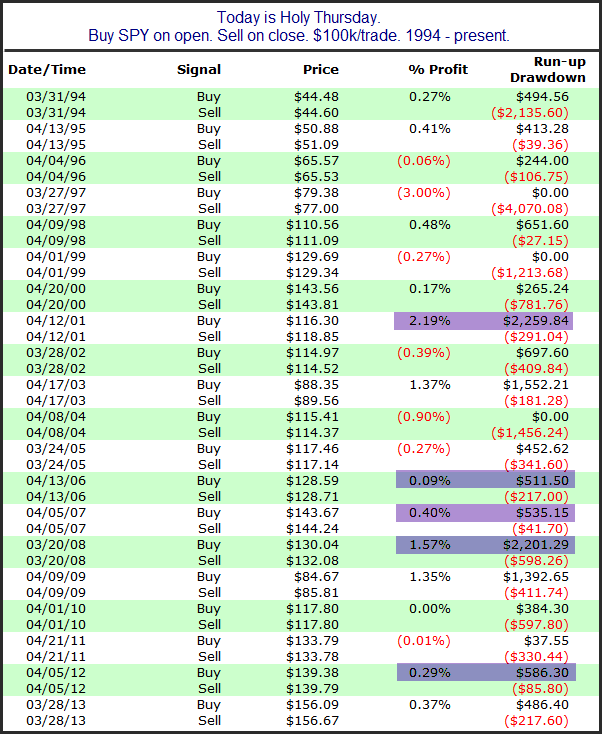

Instances highlighted in purple are the 5 that started with a gap down. All 5 of these gaps were filled at one point during the day, and all 5 instances saw SPY close above where it opened (with 2 of them making for the largest 2 gains of the 20 listed).

There are numerous ways to try and take advantage of this information. In general, traders should be aware that Holy Thursday has exhibited seasonal strength, and that strength has often begun to exert itself the night before. For a more detailed breakdown of the overnight returns, check out today’s Overnight Edges blog post.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.