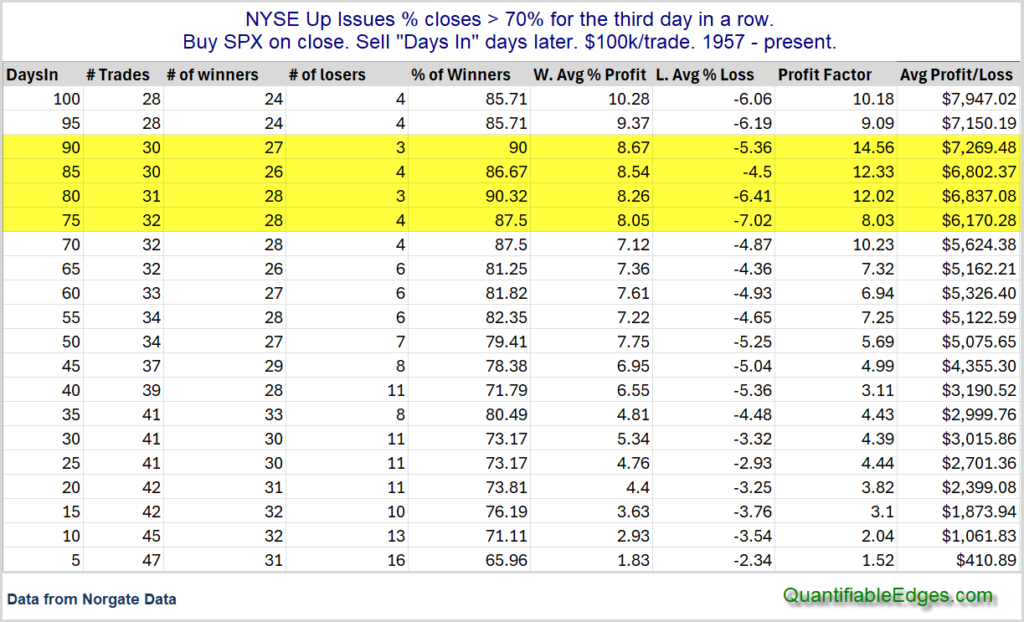

The strong breadth readings over the last few days triggered one of my oldest and most favorite studies. It looks at other times that breadth came in strong for 3 days in a row. I have shown this study many times over the years. I often refer to it as a Triple-70 Thrust, because it requires the NYSE Up Issues % to close at 70% or greater for 3 days in a row. Stats are updated.

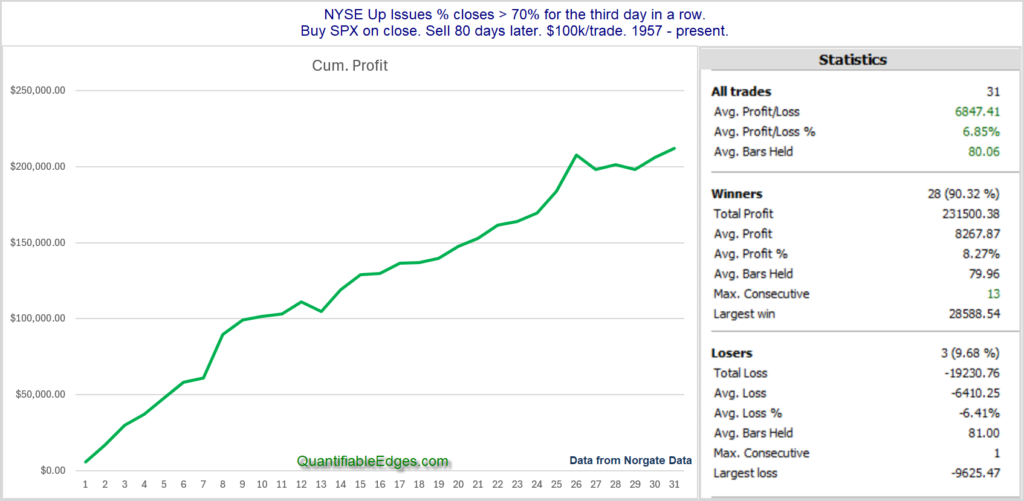

There are a lot of positive numbers and the edge generally appears to be to the upside. Results between 70 and 90 days appear especially strong and consistent. Below is the profit curve and stats assuming an 80-day holding period.

The curve and stats remain encouraging. The broad rally we have seen over the last few days appears to be a positive breadth thrust for the intermediate-term.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.

How about a free trial to the Quantifiable Edges Gold subscription?