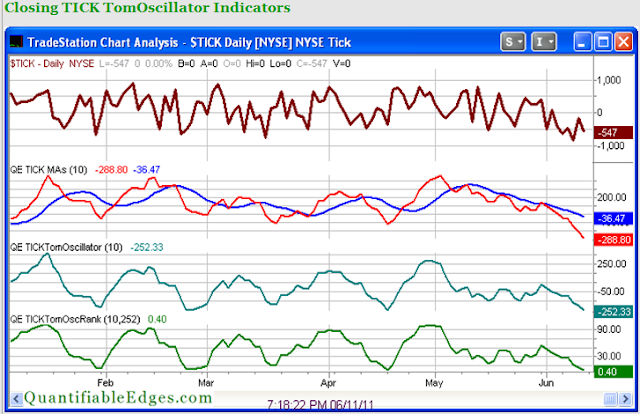

In the May 13th blog post I introduced the TICK Tomoscillator. I named it the TICK Tomoscillator because it is the brainchild of Tom McClellan of McClellan Financial Publications. It uses the NYSE closing TICK readings to measure recent end-of-day sentiment. Extremely oversold readings have typically provided a short-term bullish edge. Below is the current chart of the TICK Tomoscillator from the subscriber site.

As you can see the TICK Tomoscillator posted an extremely low reading of -252.33, which put the Tomoscillator % Rank down below 1%. This triggered a few studies that I showed in last night’s letter. One of the more compelling ones is below. It was last found in the April 19, 2011 letter and looks at TICK Tomoscillator readings below -250 that occur in conjunction with a 5-day low in the SPX.

Instances here are very low, but the results couldn’t be any more bullish. The market has recently managed to ignore most bullish inclinations and continue to selloff. We’ll see if such readings can lead to a bounce as they have in the past or whether the market continues to act in a historically abnormal way.