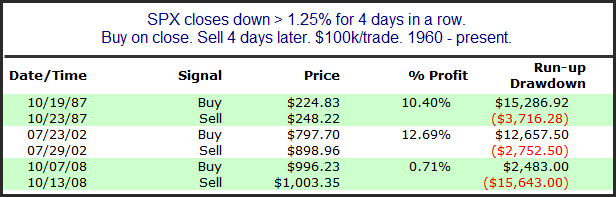

The Quantifiable Edges CBI reached an unprecedented 73 on Tuesday, besting the 2002 record of 52. (More info on the CBI can be found here.) Part of the reason the CBI is spiking so high is that we have seen a highly unusual number of consecutive days with strong (and broad) selling. In fact, Tuesday marked the 4th day in a row in which SPX closed down at least 1.25%. Below is the (short) list of other instances along with their 4-day returns.

While there are only 3 other instances, these 3 instances provide a wonderful example of the kind of extreme conditions the market is experiencing and what we may see going forward. You note that all 3 instances occurred “near” multi-week bottoms that were eventually retested. Even if I used criteria less strict than what is above, you would see a tendency for the market to bounce over the short-term.

Perhaps the biggest “lesson” from the above study is the one provided by the 2008 instance. The other instances saw strong, and almost immediate bounces. But 2008 saw a strong bout of selling before the bounce kicked in. When I said they all occurred “near” a bottom, I meant in time. The 2008 instance saw the market bottom just 3 days after it triggered. But during those 3 days the SPX declined an additional 15.6%! And by the time day 4 closed the entire drawdown had been overcome and the trade was positive. Of course traders would have had to endure a big, scary decline and hold on tight to realize that small profit in 2008.

Bringing it back to the present, with the strong selling and extreme indications we are seeing via price action, breadth, and VIX movement, I believe the environment is quite similar to those we see in the short list above. I also believe a strong bounce is likely to occur in very short order. The difficulty is that in the time between now and when the bounce truly kicks in there could be a substantial amount of short-term pain. Will the market rocket upwards from here like it did in 1987 and 2002? Or will it require an even bigger washout before bouncing as it did in 2008?

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.