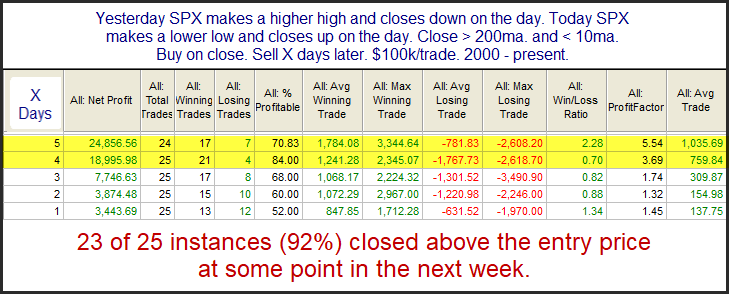

On Wednesday the bulls tried to make a move higher and failed, making for a higher high and a lower close. On Thursday the opposite happened. The bears failed in their attempt at a move lower. A study from the Quantifinder looked at 2-day moves like this. I found results to be substantially different based on whether the market is near the top or the bottom of its short-term range. When the pattern occurs in the lower end of the short-term range is has been consistently bullish over the next 4-5 days. This can be seen in the below test, which is updated.

Odds strongly favor a move higher and the profit factors are very impressive over the next 4-5 days. The failure of the bears to take control when the market pressed downward and made a lower low on Thursday has opened the door for the bulls.

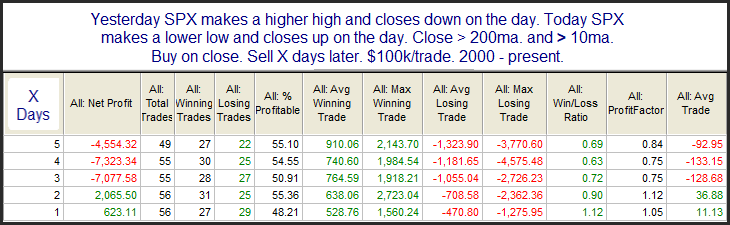

While not applicable to the current situation, I thought I’d also show the results when the pattern occurred and the SPX closed above the 10ma.

We see here that performance moving forward has been a tossup. Of course we are in the 1st situation. We’ll see if the bulls can keep the momentum over the next 4-5 days.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.