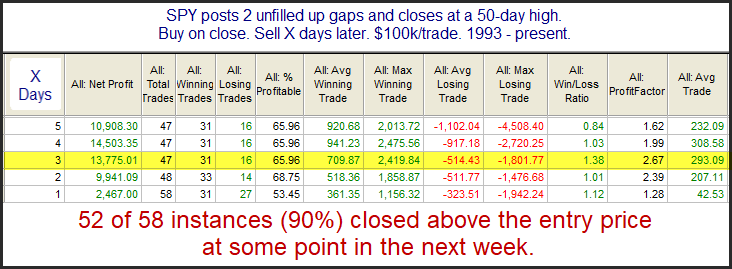

One interesting study that I discussed in last night’s subscriber letter considered the fact that SPY left an unfilled upside gap for the 2nd day in a row while closing at a 50-day high. The results table I shared can be found below.

The size of the follow-through isn’t terribly large, but it has been quite consistent that some follow through was achieved in the next few days. The market is certainly overbought here. But overbought does not always mean an immediate reversal. While evidence is mixed, (for instance, an expected substantial SOMA decline this week is creating a bearish headwind) this study suggests the kind of strength we have seen over the last couple of days is often followed by more strength. And it can serve as a nice little piece of evidence for traders to consider as they establish their market bias.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.