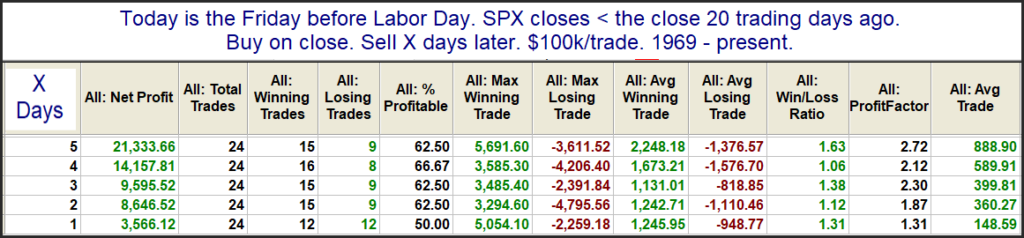

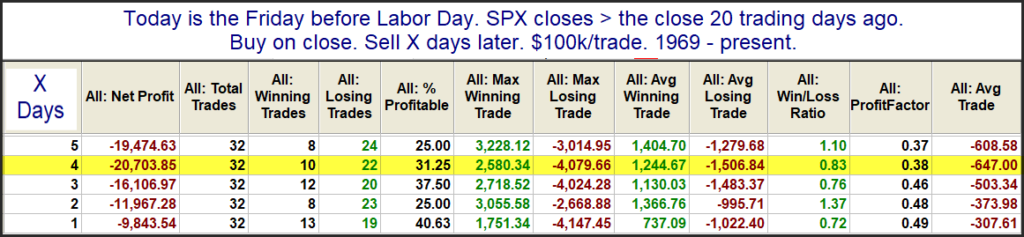

In the subscriber letter over the last several years I have demonstrated that the performance during the week of Labor Day has been impacted by the performance in the month leading up to it. Interestingly, is has been somewhat of a momentum reversal week. When SPX has rallied up to Labor Day, then it has struggled that week. And declines into Labor Day have seen positive performance. Below is an updated look at the two scenarios.

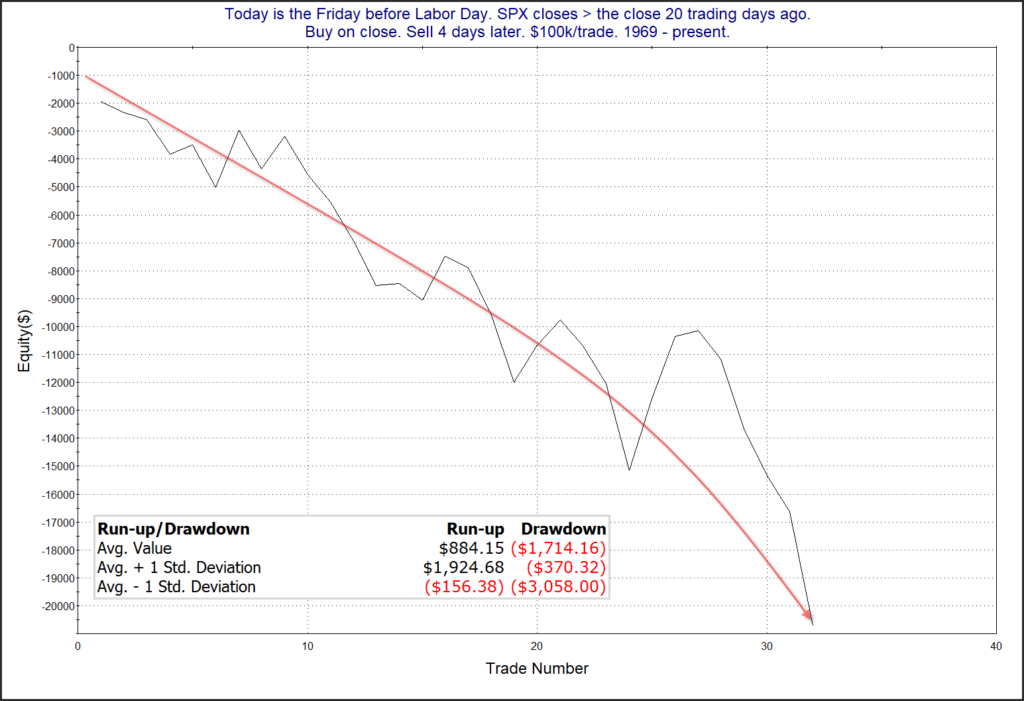

The 4-day numbers are basically inverted. So the Tues-Fri after Labor Day have not seen any consistency without the delineator. But the trend filter reveals a striking difference. Over the last several weeks the market has rallied nicely, so we are currently facing the 2nd scenario. Below is a look at the profit curve for the 4-day exit following the current setup.

Choppy but an obvious downslope. Traders may want to consider this for the upcoming trading week. Have a great Labor Day!

To see other studies featured in this weekend’s subscriber letter, check out a free trial.