While we can learn a lot from price action, it really only gives a small piece of what the market is doing. There are many other forces that play a role in determining the likelihood of future price movement. Breadth and volume are 2 that I mention every night in the Subscriber Letter.

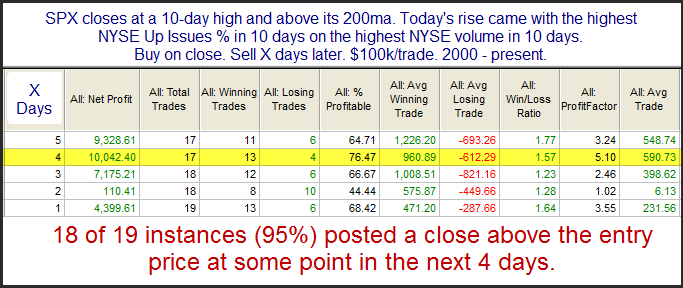

Moves to new highs are often followed by brief retracements. This has especially been true since around the year 2000. (This is when chop became favored over day to day trending activity as discussed here.) In last night’s letter I showed a study that suggested strong breadth and volume in conjunction with a new high has favored further short-term upside. That study is below.

Instances are a bit low but results are fairly compelling. I did run the results back further last night and found the edge has been present as far back as the 1970s. It became stronger after 1988.

Now let’s look at what has happened since 2000 when these new highs were not accompanied by strong breadth and volume.

The difference is striking. This is just another reminder that price action alone does not tell the whole story.