At Overnight Edges today I published a study that showed the incredible hot streak the market has been on during nights when the Employment Report was released. It got me to thinking…I know the market has done well leading up to the open, how has it done after the open? The answer is below.

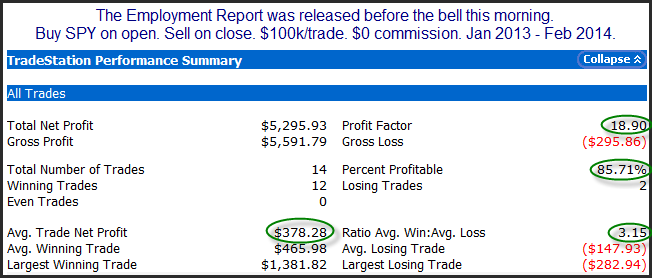

The numbers here were surprisingly good. I would have thought there would have been some give back after some of those gaps up. But the market has continued to add to its gains (or recover from overnight losses) in almost every instance. Below are all the instances since the beginning of 2013.

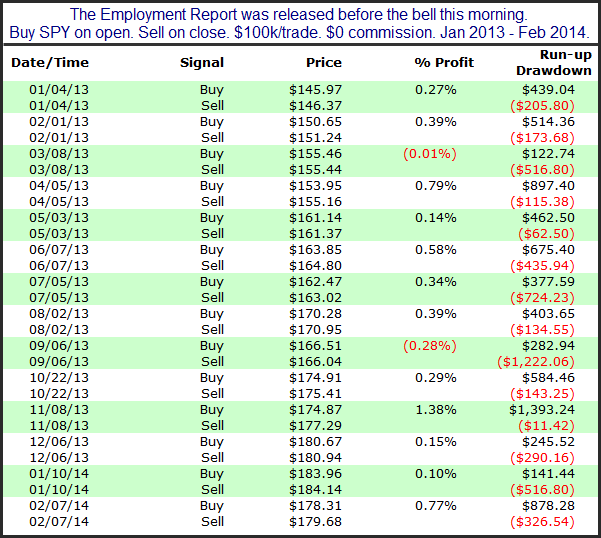

Instances here look no less impressive than the summary stats above. The only instance that lost more than $0.02 was the one on 9/6/13. Intraday traders may want to keep this bullish tendency in mind as they navigate their day on Friday.

Of course if you put these 2 studies together, and look at Thursday’s close to Friday’s close, then the numbers are even more astounding. The only loser under that scenario would have been the 4/5/13 instance which saw strong intraday gains, but could not fight its way all the way back from the massive gap down it endured.

No matter how you look at it, Employment Days have been hot, and traders should be aware of that fact when considering their strategies.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.