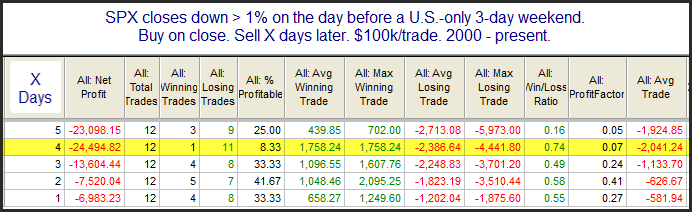

One of my former studies I looked at over the weekend examined how the market performed following large selloffs before U.S.-only three day weekends. These include Labor Day, Martin Luther King Day, Presidents’ Day, Memorial Day, and Fourth of July. Since 2000 there have been 12 instances where there was a greater than 1% selloff prior to the US-only 3-day weekend. Statistics from 1-5 days out are shown in the table below.

The initial reaction over the 1-4 day shortened week has been for downside follow-through. Instances are a bit low. But with moves lower occurring in 11 of the 12 instances, this may be worth keeping in mind as we head into this shortened holiday week.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.