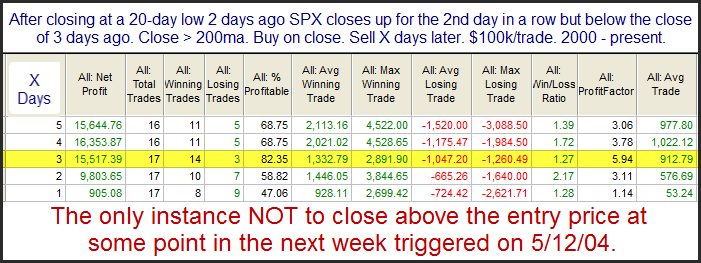

Friday was the 2nd day in a row that SPY put in an unfilled gap up (though Thursday ended with very small gains.) And while the move up on Friday was strong, it still was not strong enough to erase all of Wednesday’s losses. Wednesday was a big down day that left SPX at an intermediate-term low. The Quantifinder showed a study that examined other instances where SPX rebounded 2 days off a 20-day but failed to fully recover the losses of the previous day. I updated that study in this weekend’s Subscriber Letter and have included the stats table below.

Instances are a bit low here, but the stats are quite compelling. I suggests a short-term bullish edge.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.