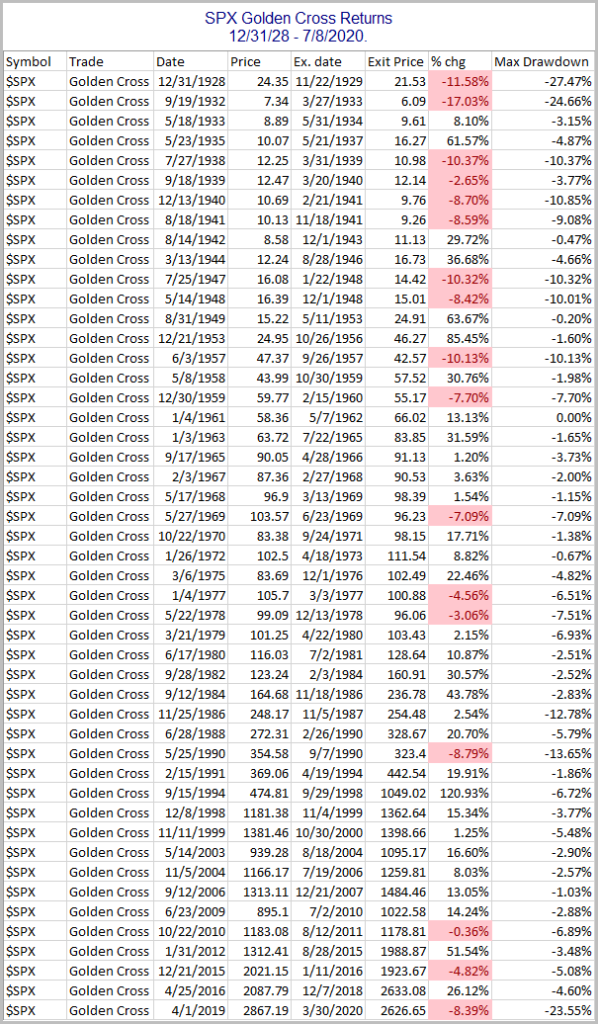

SPX will post a Golden Cross on Thursday afternoon. A Golden Cross occurs when the 50ma crosses over the 200ma. Having the 50ma above the 200ma is commonly considered a bullish market condition – and generally it is. In the 4/2/19 blog post I looked at SPX Golden Crosses dating all the way back to 12/31/1928. I have updated that research tonight with Amibroker Software and Norgate Data. Below is a list of all Golden Crosses since then. (Note that prior to 1957, S&P 90 data was used. The S&P 90 is considered the predecessor to the S&P 500.)

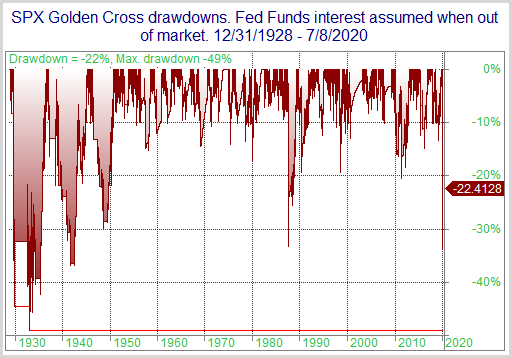

The most recent Golden Cross formation got slammed by the March COVID crash. But since the 1961 trigger, the Golden Cross has generally served as a fairly good timing device to sidestep large portions of bear markets. Prior to that it was not nearly as effective. This can be seen in the drawdown chart below. (Note: Overnight Fed Funds rate was used to calculate nightly interest starting in July 1954, which is as far back as my data goes. Prior to that, no interest rate was assumed when out of the market.)

While drawdowns have been mostly fairly moderate since the mid-50s, prior to that there were some very large drawdown to endure. Of course, the 2020 drawdown is the biggest since 1940 – and we still have a good ways to go for the system to dig out of it. Despite some fairly sizable drawdowns, the Golden Cross would have beaten “Buy and Hold” handily. It is a bullish long-term trend indication. But it is not a bulletproof long signal.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.

How about a free trial to the Quantifiable Edges Gold subscription?