A few quick highlights of what I am seeing at the moment:

1) The market is extremely stretched short-term. I am seeing many indications of this. One example is that is has now been 19 days since SPY closed below its 5-day moving average. There have only ever been 5 other times SPY has done this. None of the streaks lasted longer than 21 days.

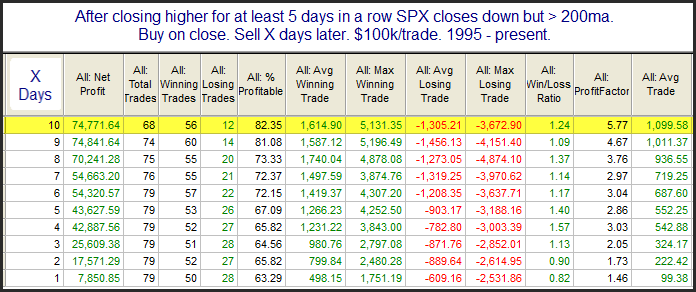

2) When the market has strong runs like it has recently, the first sign of a pullback rarely means the end of that run. This is exemplified by the study below, which triggered at the close on Wednesday.

From where I sit, when considering new short-term positions, this market is too stretched to buy and too strong to short.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.