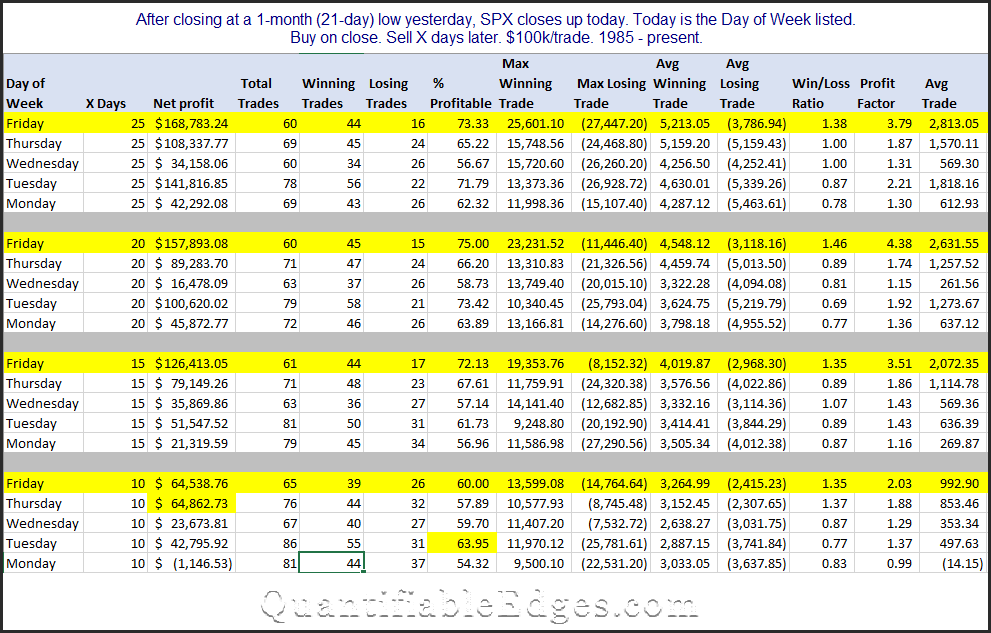

Fridays are interesting in that they are the least likely day of the week for a selloff to end or a rally to begin. But when rallies do start on a Friday, they have shown the best odds of success of any day of the week. I’ve seen this a number of ways over the years. The study below describes the current market setup. It looks at times the market closed up the day after closing at a 21-day low. Results are broken down by day of the week, and also by holding period.

Looking out 10,15,20, and 25 days, Friday has the best stats of any day. And in some cases, like 15 and 20 days out, none of the other days are even close. So if you are looking for an encouraging intermediate-term sign based on Friday’s action, this appears to be one.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.

How about a free trial to the Quantifiable Edges Gold subscription?