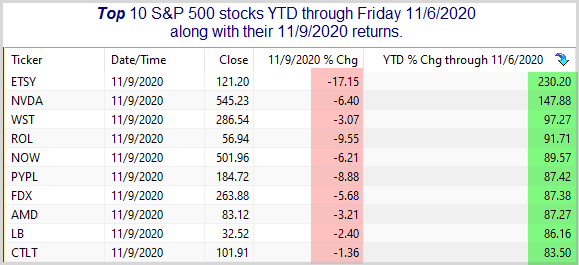

Monday saw a massive market rotation. It could be noted by the performance in the IWM vs the QQQ, or in looking at performance among S&P 500 sectors, where Energy beat Technology by 15% on Monday. But to really see how strong the rotation was, you’d need to take a look at individual stock performance within the SPX. Below is a list of the Top 10 S&P 500 stocks, ranked by YTD performance through Friday, 11/6.

Every one of the Top 10 stocks closed down on Monday, with 6 of the 10 losing over 5%. Now let’s look at how the worst stocks of the year did on Monday.

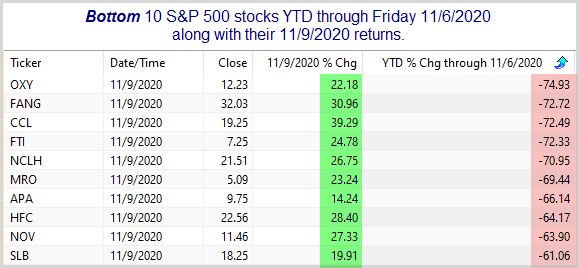

Every single one of these were up at least 14% on Monday, with most of them rising between 20% and 40%. That is a massive rotation. One way to play momentum is to get long strength and to get short weakness. That can be a profitable strategy. But on days like Monday, when the public thinks the “market” did well, you can really get served a world of hurt. Anyway, the rotation was enormous. I’m not sure what it means for the major averages going forward, but I certainly found it notable.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.

How about a free trial to the Quantifiable Edges Gold subscription?