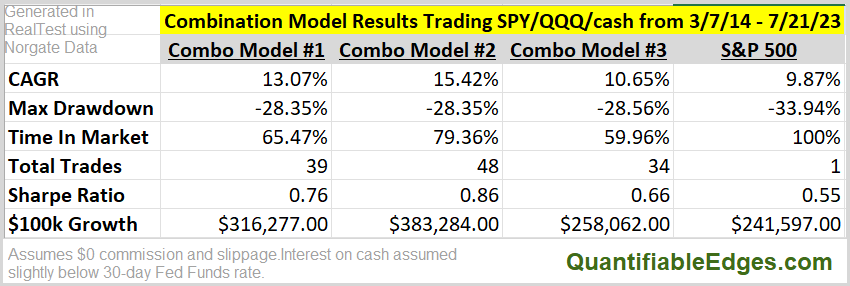

Quantifiable Edges Market Timing Course was originally released in 2014. Since then, the Combination Models presented have all soundly outperformed the S&P 500 (as shown in the table below).

Quantifiable Edges just released its 2nd edition of the course, with updated stats for the 4 original indicators and 3 original combo models. But we are also expanding the course to include a new Fed Liquidity indicator and new combination models to incorporate this new, powerful indicator.

The table below shows performance of the 3 original combination models since the release of the Quantifiable Edges Market Timing Course over 9 years ago.

All 3 models have achieved higher returns with less drawdown and reduced market exposure in live action over the last 9+ years!

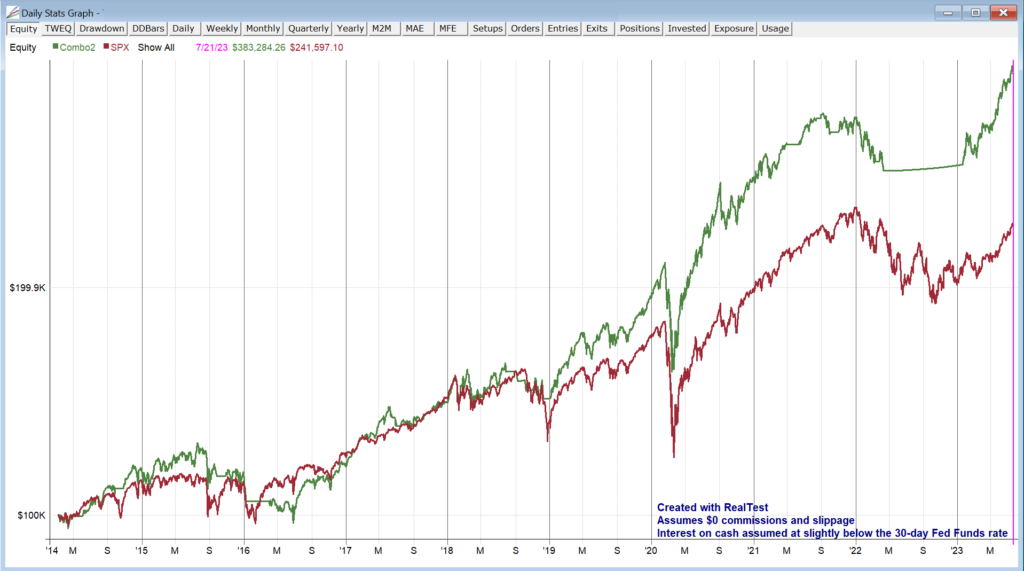

Combination #2 is the most active and aggressive version. It has been in the market about 79% of the time since it was 1st published. Over that time, there have only been 48 trades (about 5 per year), and it generated a compound annual return that outpaced the S&P 500 by 5.55% per year! Below is a profit curve of the model vs the S&P 500.

The chart was created using RealTest software, and RealTest users can easily reproduce it with the add-on code.

Now with the updated and expanded 2nd edition of the course, Quantifiable Edges introduces its Fed Liquidity indicator. The indicator is grounded in Fed-based work that Quantifiable Edges has produced since 2012. And as you’ll see in the analysis, the Fed Liquidity indicator would have acted as a better predictor of SPX movement over the last 20+ years than any of our original 4 indicators.

We then share some ideas and sample models showing how incorporating the Fed Liquidity indicator along with the original models would have produced even more impressive results than the original Combo Models.

Also covered in the course are ideas for execution, potential improvement on the models, and how they could be incorporated into someone’s portfolio.

The indicators and models are all fully open.

Excel, Tradestation, and Ninja-Trader code is available for free for the original 4 indicators.

RealTest and Amibroker code is available as an add-on. These allow you to reproduce the results of the Combination Models, tweak them however you please, and explore the indicators and ideas further!

Additionally the original course is still available for students to view and refer to so that they can easily see what was taught 9 years ago, and how it has held up over time!

Anyone can build a nice-looking backtest. Live performance is what matters. The Quantifiable Edges Market Timing Course has delivered since it was released in 2014. So sign up today, and gain a quantifiable edge over most investors! (Or sign up for an annual Gold or annual Silver subscription and get the 2nd edition of the Market Timing Course for free!)