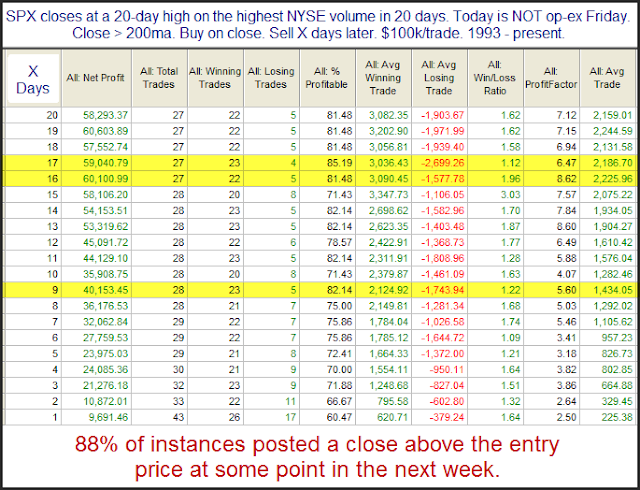

Tuesday’s rally came on the highest NYSE volume in 20 days. This is something I examined in last night’s Letter. One filter I’ve found helpful in the past is excluding op-ex Fridays since they will so often post extremely high volume. Below is a stats table from my examination.

These results appear to be very solid for both the short and intermediate-term.

I will note that there are a number of short-term studies pointing south right now. These include studies related to SPY patterns, VIX movement, and seasonality. So immediate upside follow through is very much in question despite what’s shown above. But if I see more bullish evidence emerge over the next few days this study could provide a nice start in building a bullish outlook.