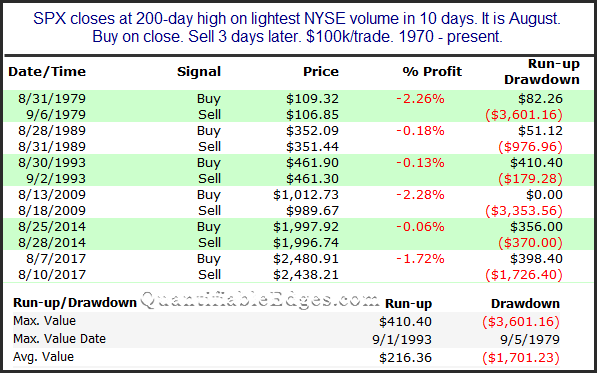

SPX closed at a new all-time high on Friday. But NYSE volume came in at the lowest level since mid-July. Low volume at new highs can sometimes be a negative. Of course August frequently has low volume as many market participants are on vacation and not trading as actively. So I decided to look back at other times the SPX made a long-term high on light volume during the month of August. Results were bearish from 1-15 days out. The downside was generally realized over the next 3 days, though. Below is the list of instances along with their 3-day results.

It appears these low-volume August moves to new highs have not seen short-term follow-through momentum in the past. The number of instances is low, but all 6 saw the market lower 3 days later. So perhaps it is worth some consideration when determining your market bias over the next few days.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.