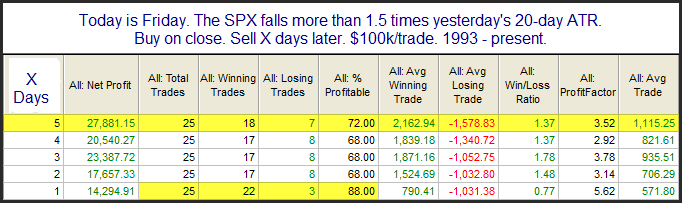

In the November 2, 2009 blog post I examined Monday reactions to very bad Fridays. While Friday didn’t qualify for that study, I did look at large Friday drops another way this weekend. This time I used Average True Range (ATR) to define “large”. If the size of the drop was larger than 1.5 times the 20-day ATR then regardless of the size of the % drop, that was considered “large”. Drops of this magnitude on a Friday have almost always led to a bounce.

An 88% bounce rate the next day is extremely impressive – especially considering the study is only based on 2 simple parameters (day of week and large drop). The Crash of ’87 occurred on a Monday after a sizable drop on Friday. The Crash of ’29 also occurred on a Monday. It seems that Wall St.’s collective consciousness since over the last several years calls for protecting yourself going into the weekend if Friday is bad. This suggests that big drops on Fridays have often been overreactions and have therefore resulted in a consistent propensity to bounce on Monday.