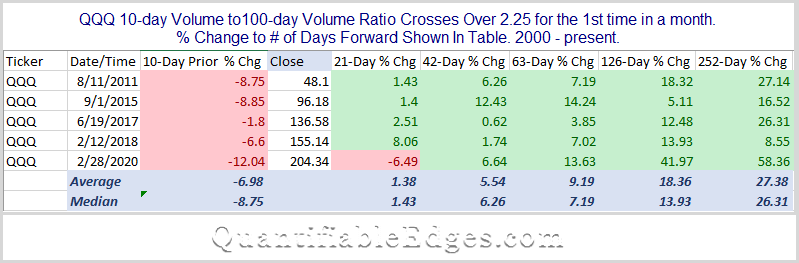

My friend and colleague Tom McClellan writes the excellent McClellan Market Report. In his report last night he noted that big spikes in QQQ volume are often a bottoming sign for QQQ. He shared a chart showing that the 10ma of QQQ volume was now at an extreme level. I decided to study this idea a bit more. So I took the 10ma of QQQ volume and compared it to the 100ma of QQQ volume, in order to normalize it for historical comparisons. On Monday the QQQ 10/100 Volume Ratio rose from 2.23 to 2.33. That is a very high level – more than twice “normal”. I looked back at all other times the ratio crossed above 2.25. This is only the 6th such instance since QQQ inception in 2000. Below is the list of others along with their 1, 2, 3, 6, and 12-month returns.

A few things to note here:

- All 5 previous volume spikes occurred with a selloff over the last 10 days. Fear related to the selloff is typically what will cause such spikes. You don’t see big spikes in volume due to rallies. The current instance is no different. QQQ has declined 7% over the last 10 days.

- Intermediate-term returns are bullish across the board. All 5 instances were higher 2, 3, 6, and 12 months later – and by substantial amounts.

Now this study is not to be taken as any kind of guarantee. The number of instances to examine is very low. Additionally, they have all occurred over the last 10 years, which is a period of time that the QQQ has rallied strongly. So multi-month gains would generally be expected. But even with flaws in my study, the concept appears to have merit. Similar spikes in QQQ volume have always occurred during selloffs, and have always been followed by intermediate-term gains. So Tom’s observation certainly seems worth keeping in mind. (Not a surprise – he has lots of interesting and worthwhile observations.)

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.

How about a free trial to the Quantifiable Edges Gold subscription?