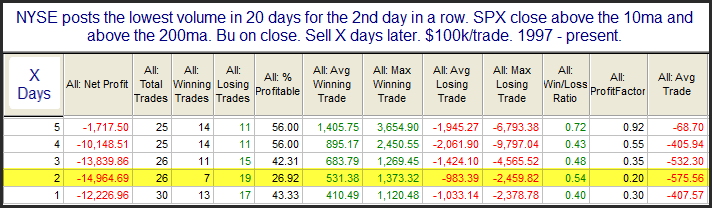

One notable about Tuesday’s rally is that it marked the lowest volume in over a month for the second day in a row. The Quantifinder identified a study I did about 3 years ago that looked at low-volume setups like this when SPX closed above both the 10-day and 200-day moving averages. I went back and took another look last night. Below is an updated results table.

The numbers appear to suggest a downside edge over the first couple of days. Of course results for today and tomorrow will be heavily influenced by the market’s reaction to today’s Fed announcement.

Fed Days have long carried a strong upside bias. But when the market is already near an intermediate-term high this upside bias has not been as prevalent.

I am certainly seeing some crosswinds at the moment. The volume-related study above appears to be a negative, and while it is not the only factor ruling the market at the moment, it seems worth some consideration.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.