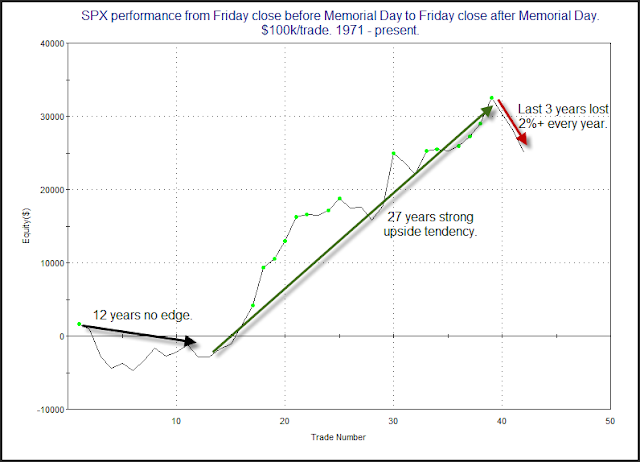

The week of Memorial Day has shown some bullish seasonal tendencies over the years. But it has certainly faltered the last few. The chart below is from this weekend’s subscriber letter. It examines returns during the week of Memorial Day.

From 1983 – 2009 Memorial Day week performed exceptionally well. During that time span it rose 20 of 27 years. It never closed down more than 2 in a row. And it never had a losing week of even 2%. But the last 3 years? It has lost 2%+ all 3 years. So it raises the question, has good seasonality gone bad?

It’s possible and it has happened with other seasonal edges in the past. It will be interesting to see how it plays out over the next few years, and whether then bullish tendency returns. For now I am simply less inclined to put weight in Memorial Week seasonality, and rather trust to my other indicators and studies.

Update: I also looked at Memorial Day week nightly performance at Overnight Edges.