Debt ceiling progress has the market gapping up this morning. As I type the SPY is up between 1% and 1.5% pre-market. Below I take a look at gaps up from a 20-day low based on the size of the gap. First are gaps between 0.75% and 1.5%.

12 of the last 13 have been losers with the 1 winner only posting a gain of 0.1%.

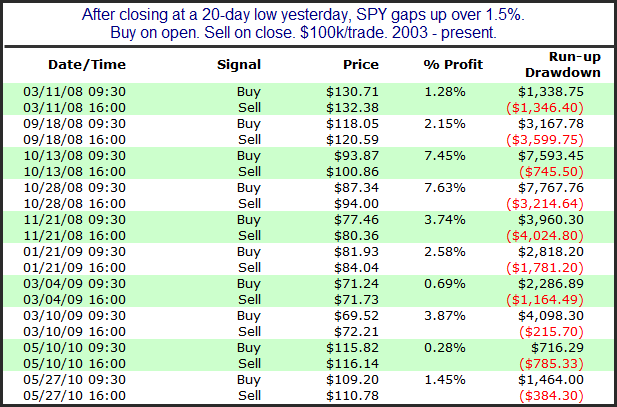

Next is a look at gaps of 1.5% or more.

It appears the larger the gap the higher the propensity for it to run after the open.

One other factor that traders may want to consider about the potential of today’s gap is the 1st of the month seasonality. I looked at this in combination with large gaps last December.