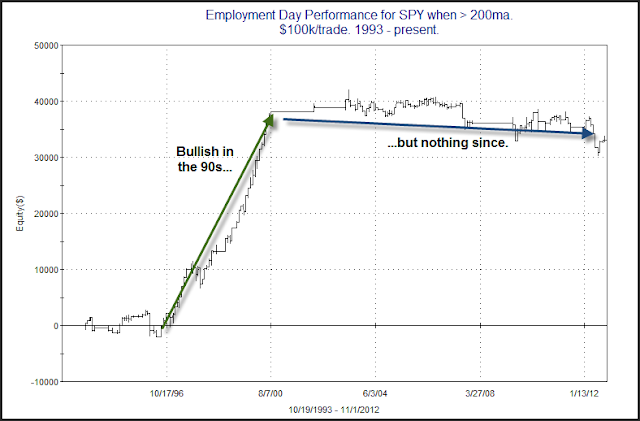

Employment days have an interesting history and they have contributed to some worthwhile studies over the years. By “Employment Day” I mean days that the Federal Employment Report will be released. This occurs once per month and is normally on the 1st Friday of the month. Below is a chart of SPY performance on Employment Days during bull market environments. Each trade was a fictional $100k.

What I find so interesting about the chart is that for a long time Employment Days in uptrends showed a strong propensity for gains. But in 2000 this edge vanished. Since then there has been no apparent advantage – bullish or bearish. While it’s unusual to see such an abrupt change in market dynamics, it does serve as a nice reminder that such changes are always possible.