Monday is the 1st trading day of the month. The 1st trading day of the month is renowned for having a bullish tendency, and this has been the case since the late 80s. But this tendency has primarily played out during uptrending markets. During down times the 1st of the month has not been particularly bullish. This was illustrated quite nicely by my friend and fellow market analyst, Tom McClellan, in his “Chart in Focus” column on Friday. Using the 200ma as our measure of uptrend versus downtrend, I will demonstrate this concept numerically below.

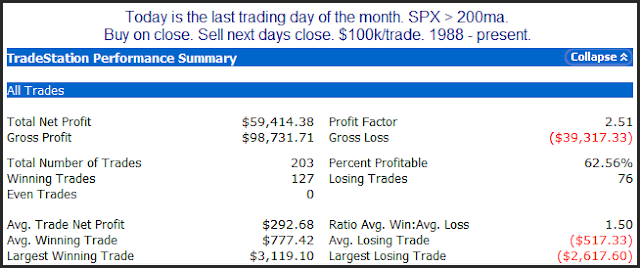

This first study shows results since 1988 of committing $100k per trade on the 1st of the month if the SPX is trading above its 200ma.

The numbers all look very solid. About 2/3 of the trades were winners, and the winners were about 1.5 times the size of the losers, making for a profit factor of over 2.5.

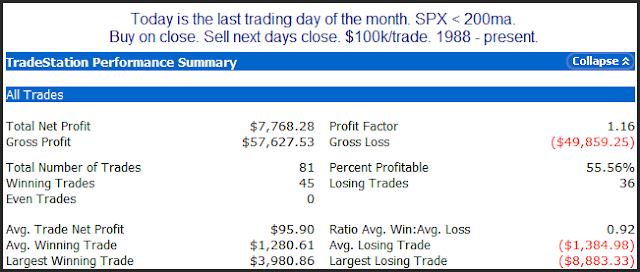

Next let’s look at times like now when the SPX is below its 200ma.

The numbers here net out to a positive number, but just barely. It certainly doesn’t appear to be anything you would want to base a trade on.