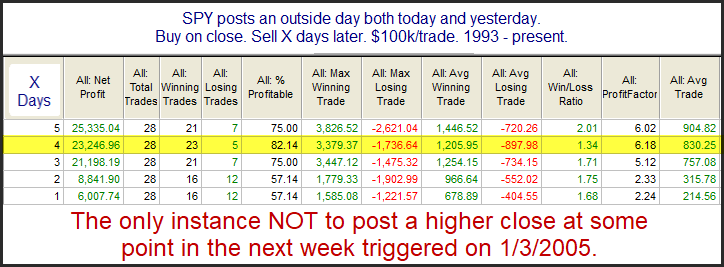

Notable about Tuesday’s action is that it marked the 2nd day in a row that SPY posted an outside day. (An outside day is a day where the security or index makes a higher high and a lower low than the day before.) I last discussed back-to-back outside days in the 7/28/16 letter. I have updated those results below.

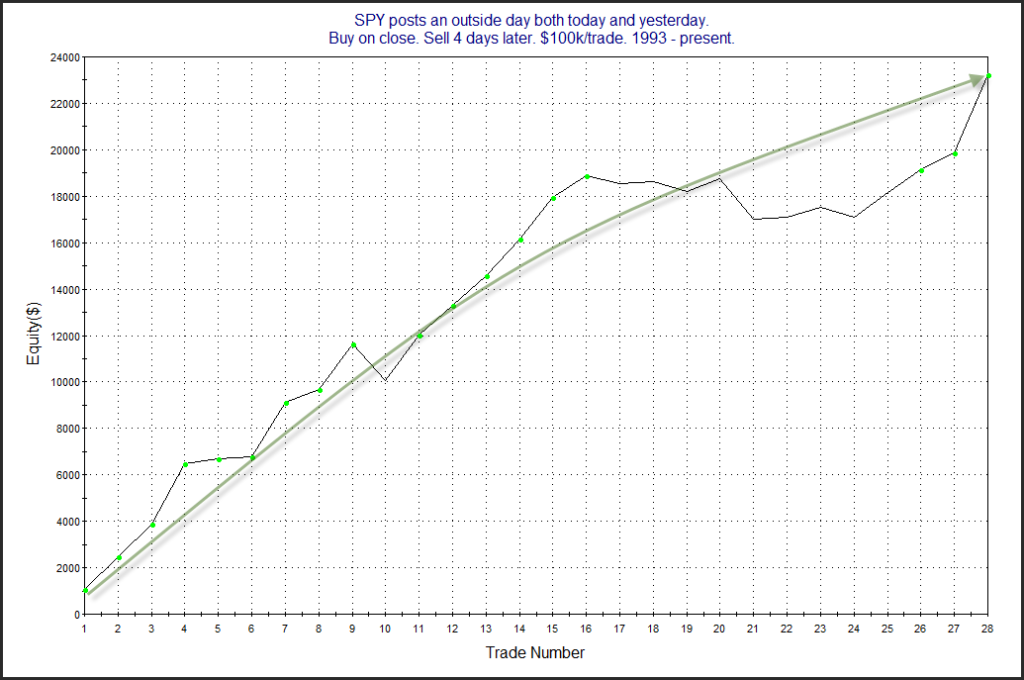

The numbers look very impressive. Most of the upside edge has been realized in the 1st 4 days. Below is a profit curve using a 4-day holding period.

The move up is impressive and encouraging for the bullish case.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.

How about a free trial to the Quantifiable Edges Gold subscription?