A couple of years ago on the blog I showed a study suggesting that Labor Day week performance has been somewhat dependent on whether the market has rallied over the 20 trading days leading up to it. I decided to update that study today. Below is a look at post-Labor Day performance when the previous 20 days have seen gains versus losses. First lets look at rises into the holiday (unlike now).

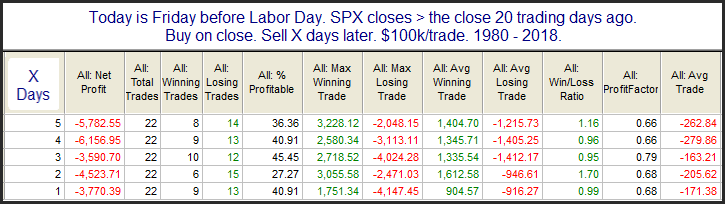

This shows a poor performance record when there has been a rise in the market. But in 2019 SPX has posted a decline over the last 20 days. So we are facing the below scenario.

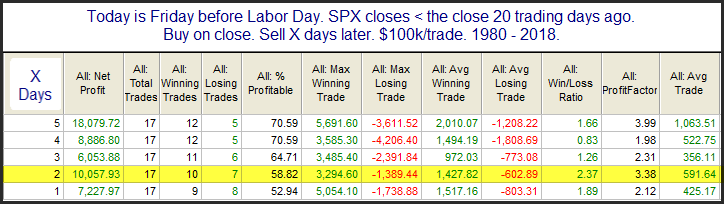

Just the opposite here. The market appears to lean towards gains during Labor Day week under such circumstances. Of course there are a few caveats to keep in mind. For one, instances are a bit low. Secondly, while we are down over the 20-day period it is not by much, and with SPX near the top of its recent range, any “oversold” edge here may not be in place. Still, the results do give us some information to consider as we head back to work on Tuesday. Happy Labor Day!

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.

Learn how to identify edges and formulate swing trading strategies with the Quant Edges Swing Trading Course!