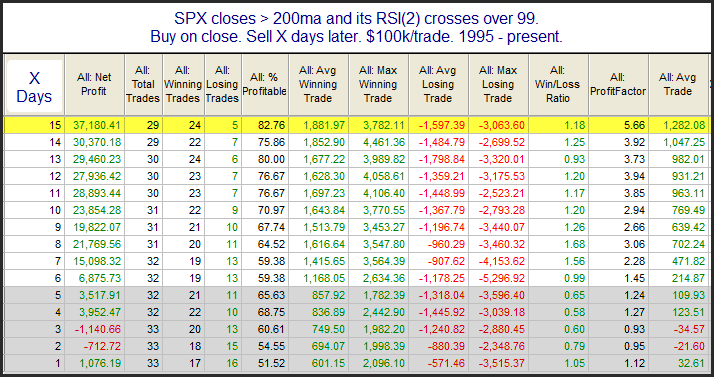

The market is short-term overbought by a number of measures. One measure that short-term traders will sometimes look at is the 2-period RSI. On Friday the 2-period RSI for SPX close over 99 for the 1st time since February. Very strong moves that put a stock or market in an extremely overbought short-term condition can mean that a pause or pullback is needed short-term. But for the intermediate-term it often bodes well. This can be seen in the study below.

The numbers here are basically neutral for the first week or so. But once you get out 2-3 weeks, it appears the strength has re-asserted itself and the market is often higher. This is an example of how strength can beget more strength. Traders may want to keep this in mind over the next few weeks.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.