Last week on the blog I showed an indicator that measured the amount of POMO stimulus the Fed has injected into the system over a 1-month (20 day) timeframe. As a review POMO stands for Permanent Open Market Operations and it is how the Fed goes into the open market to buy (or sell) treasury securities. The net effect of this buying is an influx of cash into the system. It appears a portion of that cash makes its way through the banking system and into the stock market. It also appears that the net effect of all this Fed buying is a positive influence on the stock market.

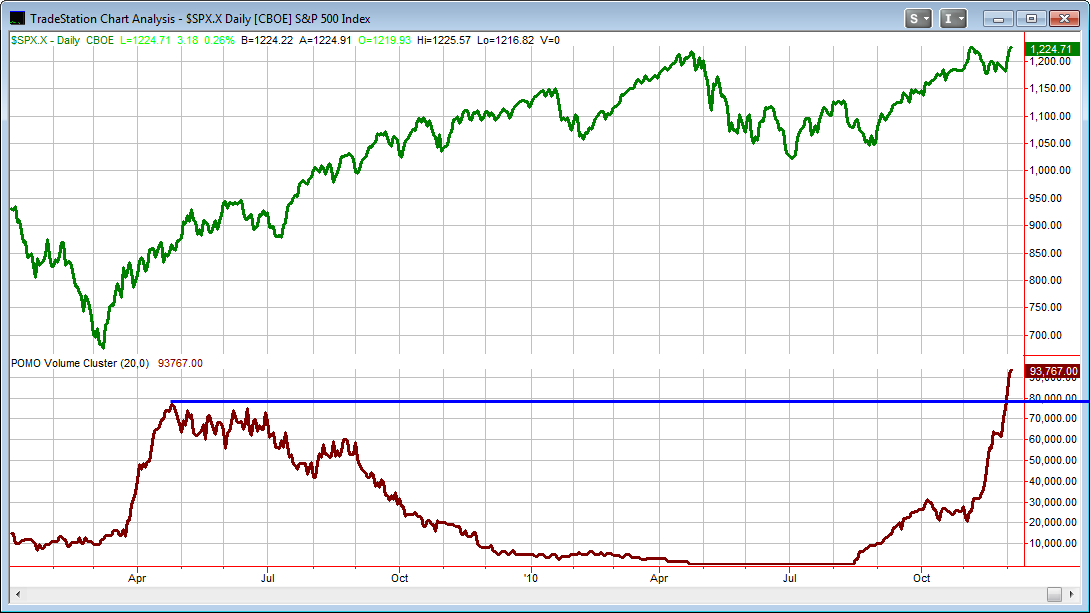

Today I have updated the chart from last week. The top panel shows the S&P 500. The indicator on the bottom is the total POMO buying in dollars that the Fed has done. I’ve zoomed in to just show the last year and a half.

As you can see the POMO buying over the last month has now far exceeded any 20-day period in 2009 (or ever). According to the Fed’s website Mon-Thurs of this week are also scheduled for POMO activity. And a new schedule is due out on Friday so there is a chance we’ll continue to see strong Fed buying in the weeks ahead. Evidence suggests to me that this should have a bullish influence on the market.