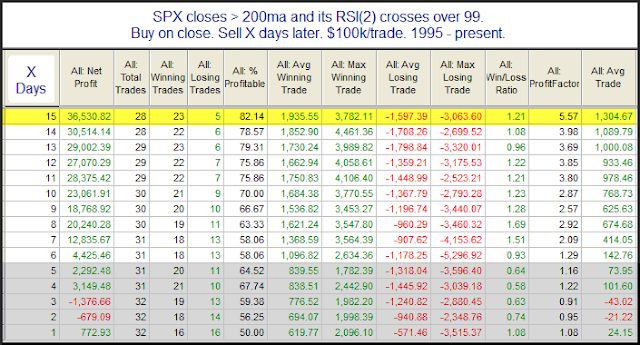

When the market starts to get short-term overbought we often see studies pop up that suggest a downside edge. But when the overbought condition gets very strongly overbought, then those downside edges often disappear. And rather than strength leading to weakness the strength will beget more strength. The strong move higher over the last several days has turned the market so overbought that downside edges are no longer prevalent. We saw this in a study yesterday morning and another one popped up Tuesday afternoon. The study below exemplifies the kind of extreme short-term overbought scenario the market is now in.

The numbers here are basically neutral for the first week or so. On a short-term basis there is no edge apparent. But once you get out 2-3 weeks, it appears the strength has re-asserted itself and the market is often higher.