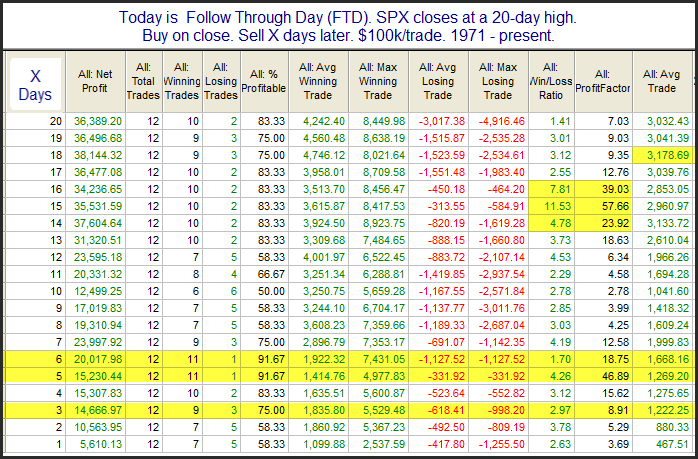

Tuesday posted the 1st IBD Follow Through Day (FTD) since the rally began. Unusual about this FTD is that it occurred in conjunction with SPX making a new 20-day high. The study below examines other times a 20-day high was accompanied by a FTD.

Results here are impressive over both the short and intermediate-term. To get a better feel for the short-term returns I have listed the instances below.

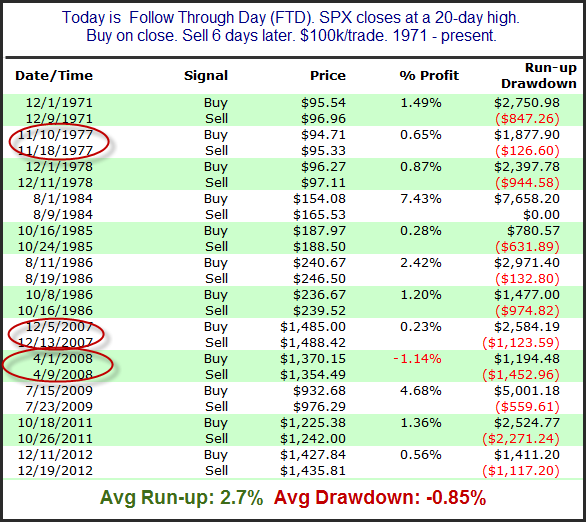

The run-up to drawdown ratio here is quite impressive. I’ll also note that 9 of the 12 instances went on to have “successful” rallies. (“Success” means it either hit a new 200-day high or at least rose 2x as much as it had already risen off the bottom.) The 3 instances whose rallies did not succeed (circled in red) all saw run-ups of at least 2% before they eventually rolled over and made new lows.

A summary of some of my past FTD posts can be found here. Or for the complete list of past FTD studies click here.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.