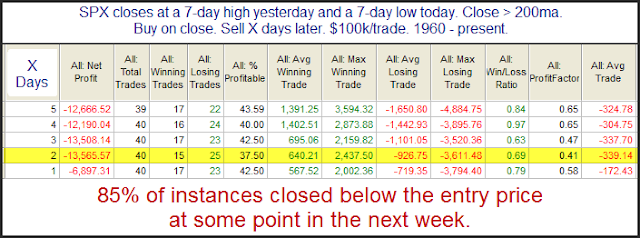

After closing at a new high on Friday, SPY reversed so hard on Monday that it closed at a 7-day low. Way back in the 6/19/09 blog I looked at 1-day moves from a 7-day high to a 7-day low. I have updated those results below and also incorporated a 200-day moving average filter.

There appears to be a bit of a downside edge over the next few days, and much of that edge has played out during days one and two. Perhaps the quick move through 7 days of resistance causes weak hands to bail and further selling to ensue.

It will be interesting to see how it plays out today because it appears SPY may have a large gap up when the market opens in about an hour. Gaps up from low areas are less likely to fill, leaving shorts stuck and chasing the markets upwards. If the gap can hold, then we may avoid the further selling suggested by the study. If the gap up fills, then the move lower could quickly accelerate.