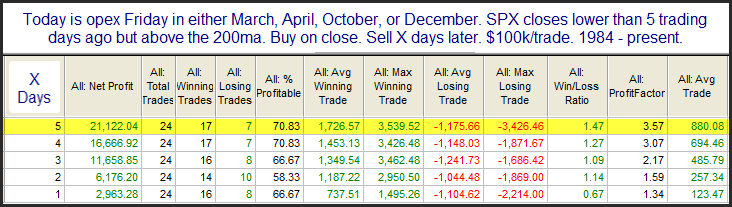

I discussed last weekend that monthly option expiration (opex) week is typically a bullish week, especially during the months of March, April, October, and December. Obviously, the bullish tendency did not play out this past week. So does this mean the bullish tendency may be delayed a week? Or is the market not doing what it is “supposed” to a sign that it is likely to continue lower? Or neither? I constructed some studies to find out. This 1st one looks at instances like we are currently experiencing where typically bullish opex weeks fail to deliver.

The numbers here all point towards an upside edge. The edge improves as we look out from 1 to 5 days. But how does this differ from performance following instances that saw the bullish opex week tendency play out? For comparison, I flipped that requirement and have shared those results below.

So without the opex-week selloff, the following week has not shown a bullish tendency. Based on all this, it appears the bullish tendency has typically arrived late, and it portends a bounce this upcoming week.

Hat-tip to @McClellanOsc for the idea to test!

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.