Every once in a while I come across a study that reminds me an awful lot of Longfellow’s “The little girl”.

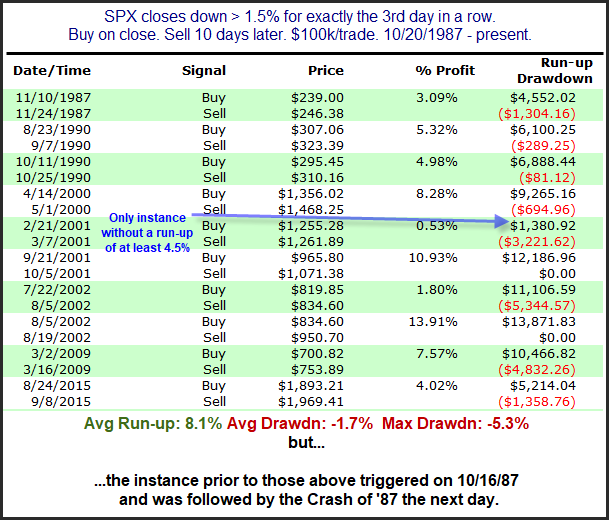

After the strong and persistent selling over the last few days I decided to examine other times like now where the SPX dropped at least 1.5% for 3 days in a row. The study below looks back to late 1987 and shows all 10 occurrences over the time period, along with their 10-day returns. The consistency and size of the bounces over the next 10 trading days is “very good indeed”.

But the prior instance noted at the bottom of the list was “horrid”.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.