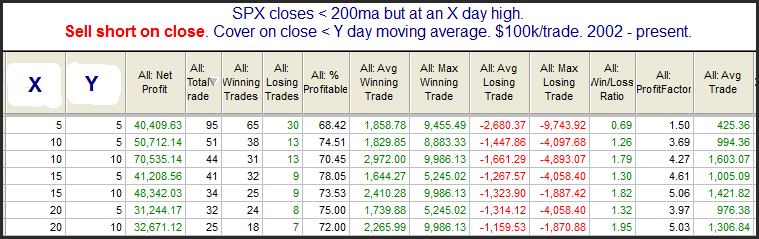

SPX closed at a 10-day high on Tuesday. New short-term (and intermediate-term) highs will sometimes get traders excited. When the market is in long-term downtrend mode, this excitement is often misplaced. Way back in a blog post on 4/3/09 I showed a number of “systems” that looked to sell short when the SPX made X-day highs but was below the 200ma. I have updated the results table of those little systems below.

Stats here are solid across the board. The Win Rate, Profit Factors, and Average Trade stats all suggest a good chance at market dip. Hitting new short-term highs is generally not something that bulls should get excited about while the long-term trend appears down.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.