I’ve shown before that inside days in long-term downtrends are often short-term bearish. (An inside day is a day like Friday where the market makes a higher low and a lower high than the day before.) So what if that inside day closes higher and comes immediately after a 20-day low like we are seeing now?

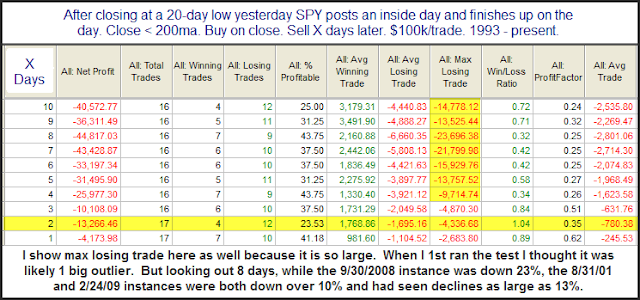

Instances are a little low but initial results here appear quite bearish. As I note below the chart I also included a column showing the max losing trade. While it is very large, it was not just one outlier, but 3 extra large decliners that cause the average trade to look so weak. Note though that even 2 days out, prior to the extra large declines taking place, the edge still appeared fairly bearish.

Of course the market appears ready to gap up big this morning. There is certainly the possibility that a large gap up could trigger a short-selling rally which would run overrun the inclinations of this study.