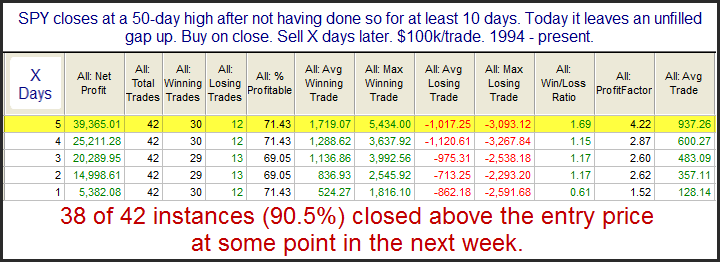

On Monday SPX broke out and made new highs for the 1st time since January. And a strong open meant that SPY left an unfilled gap up. The study below is one I have shown a number of times in the past, but I always feel it is worth a reminder when we have a new SPY breakout. It demonstrates the importance of the unfilled gap in generating momentum for the next few days.

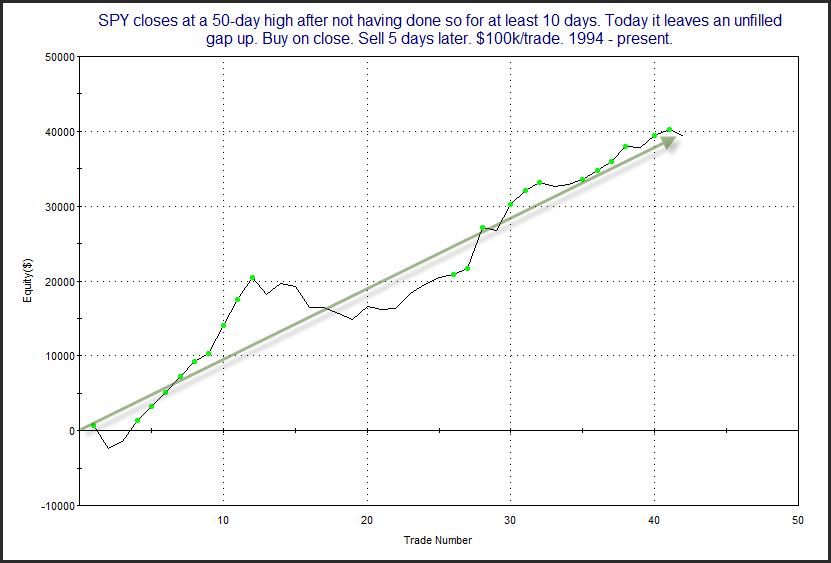

Results here are strong across the board. Below is an equity curve using a 5-day holding period.

The nice upslope on the equity curve confirms the bullish inclinations.

Technicians will often use the term “breakaway gap”. This suggests the gap occurs on the same day as a base breakout. The idea is that the new high causes excitement and the gap leaves a good amount of people sidelined or stuck short. When it doesn’t immediately fill, it leads these people to chase and helps to propel the market even higher.

Now let’s look at instances where the 50-day high breakout was not accompanied by an unfilled gap. Interestingly, the number of instances was nearly the same.

As you can see these moves to new highs that don’t start with an unfilled gap are much less reliable.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.