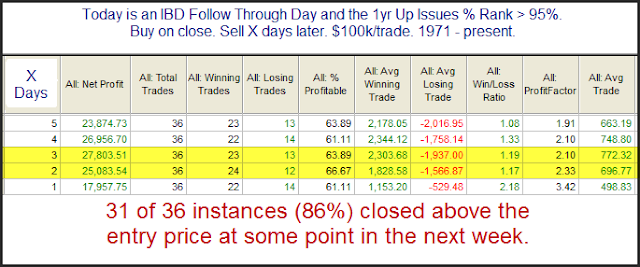

The strong move higher on increased volume meant that Tuesday was a Follow Through Day (FTD). FTDs are a concept that was created by William O’Neil, founder of Investors’ Business Daily. I have written about them extensively on the blog. In June for the 1st time I showed that FTD’s have a better chance of success when they are also accompanied by strong breadth. Tonight I also examined the short-term implications to FTDs with strong breadth vs. FTDs without. This first study below looks at performance following FTDs that came along with an Up Issue % reading that was among the top 5% of all readings over the previous year.

As you can see there appears to be an tendency for the market to continue higher after these strong-breadth FTDs. Now let’s examine performance after FTDs on days that did not show exceptional breadth strength.

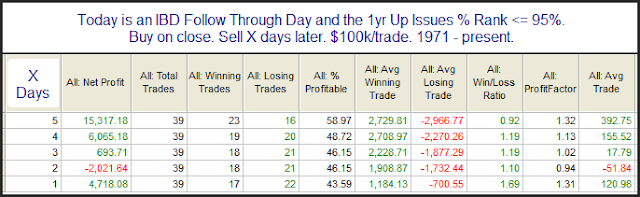

Here there appears to be no edge or short-term upside inclination whatsoever. With Tuesday’s FTD coming on breadth that put it in the top 2% of all days for the last year the short-term outlook appears better.