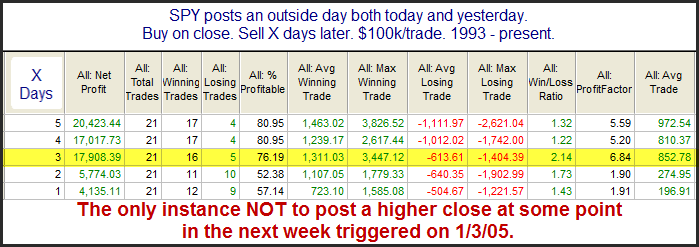

Notable about Friday’s market action is that it marked the 2nd day in a row that SPY posted an outside day. (An outside day is a day where the security or index makes both a higher high and a lower low than the day before.) Back-to-back are fairly rare. I last discussed this setup in the 1/10/2014 blog. Below are updated results.

The numbers look very impressive. Most of the upside edge has been realized in the 1st 3 days.

It is also worth noting that this pattern has also done well with QQQ in the past.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.